Featured Listings

Who We Are

As a CIR REALTY Agent and member of Leading Real Estate Companies of the World, my goal is to ensure that you have the best real estate experience possible.

Read More

Read More

Real estate is the most serious and expensive transaction in an average person?s life and clients must be treated with total integrity and respect and given the information they need.

CIR Realty Blog by Ali Mamdani

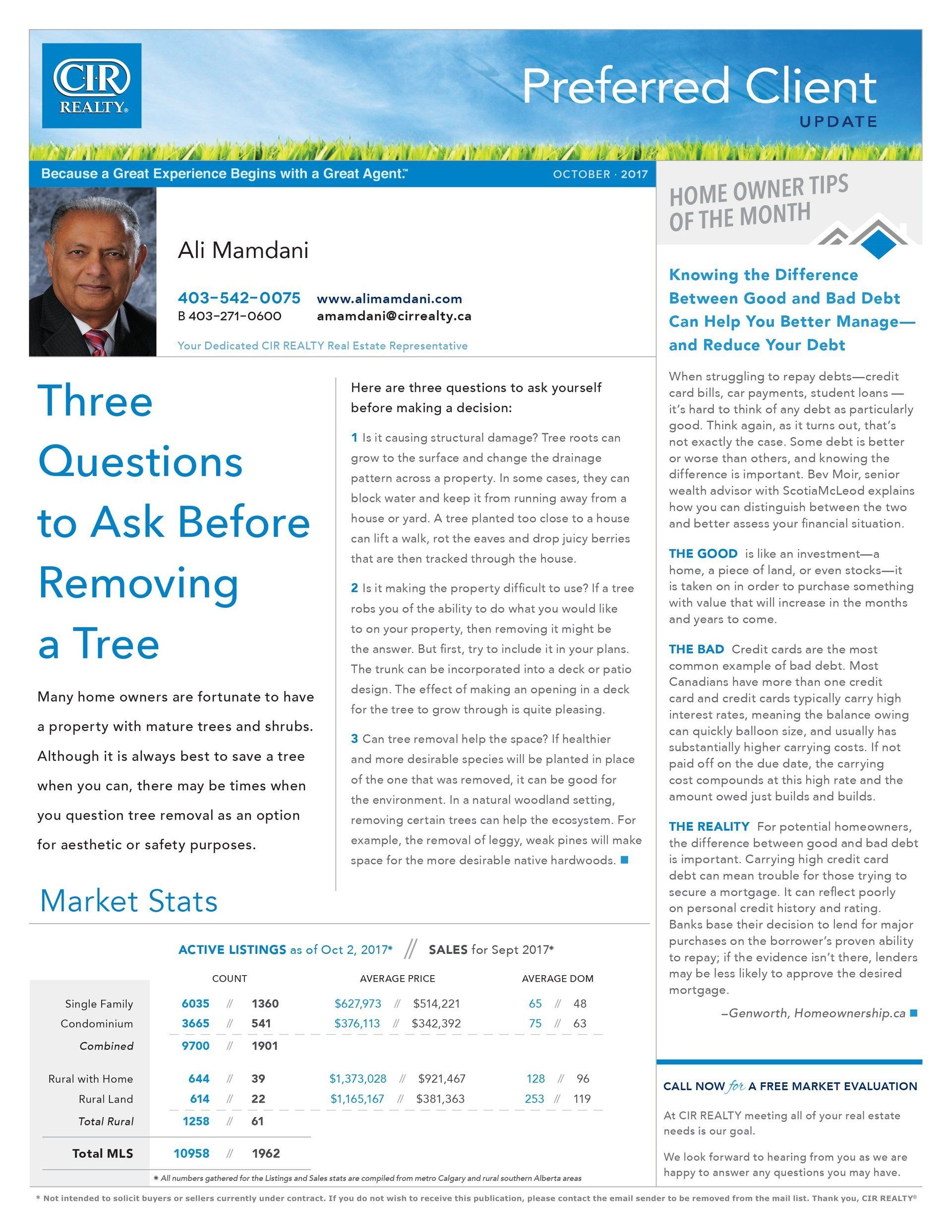

Many home owners are fortunate to have a property with mature trees and shrubs. Although it is always best to save a tree when you can, there may be times when you question tree removal as an option for aesthetic or safety purposes.

Here are three questions to ask yourself before making a decision:

1. Is it causing structural damage?

Tree roots can grow to the surface and change the drainage pattern across a property. In some cases, they can block water and keep it from running away from a house or yard. A tree planted too close to a house can lift a walk, rot the eaves and drop juicy berries

that are then tracked through the house.

2. Is it making the property difficult to use?

If a tree robs you of the ability to do what you would like to on your property, then removing it might be the answer. But first, try to include it in your plans. The trunk can be incorporated into a deck or patio design. The effect of making an opening in a deck

for the tree to grow through is quite pleasing.

3. Can tree removal help the space?

If healthier and more desirable species will be planted in place of the one that was removed, it can be good for

the environment. In a natural woodland setting, removing certain trees can help the ecosystem. For

example, the removal of leggy, weak pines will make space for the more desirable native hardwoods.

Here are three questions to ask yourself before making a decision:

1. Is it causing structural damage?

Tree roots can grow to the surface and change the drainage pattern across a property. In some cases, they can block water and keep it from running away from a house or yard. A tree planted too close to a house can lift a walk, rot the eaves and drop juicy berries

that are then tracked through the house.

2. Is it making the property difficult to use?

If a tree robs you of the ability to do what you would like to on your property, then removing it might be the answer. But first, try to include it in your plans. The trunk can be incorporated into a deck or patio design. The effect of making an opening in a deck

for the tree to grow through is quite pleasing.

3. Can tree removal help the space?

If healthier and more desirable species will be planted in place of the one that was removed, it can be good for

the environment. In a natural woodland setting, removing certain trees can help the ecosystem. For

example, the removal of leggy, weak pines will make space for the more desirable native hardwoods.

“Should I sell in this Buyer’s Market or wait until we’re in a Seller’s Market

again?”

Increases to income tax rates

brought in by the new provincial

government have come fully into

effect in after being partially

implemented in October of 2015.

Let’s be honest, nothing really matters unless you know how you’re going to pay for your next home or investment property. The reality is that anyone (and I mean anyone) can find the money to purchase a home. In fact, we have seen people who are over $70,000 in debt, unemployed, and on the verge of bankruptcy purchase not one, but multiple homes at the same time. Sound impossible?

Many people want to know what the secret is to getting the most out of their real estate and to appeal to most consumers looking for real estate today. This report will guide you through doing many of those things to help get the most dollars when selling your property.