Finding the Money

- By Ali Mamdani

- •

- 15 Apr, 2016

- •

(A Simple Guide to Getting You Approved)

Let’s be honest, nothing really matters unless you know how you’re going to pay for your next home or investment property. The reality is that anyone (and I mean anyone) can find the money to purchase a home. In fact, we have seen people who are over $70,000 in debt, unemployed, and on the verge of bankruptcy purchase not one, but multiple homes at the same time. Sound impossible? Read on . . .

Perhaps you have good credit, a down payment and qualifying for financing will not be a problem, but you want the best mortgage for your needs, and of course, the lowest interest rate available. Sound like you? Read on . . .

Or maybe you just have no idea what you qualify for, this is your first purchase and you just want to learn how to get started (on the right foot). Well, read on . . .

Below is a brief outline of some basic components of getting financing and some tips to get you well ahead of the game.

Perhaps you have good credit, a down payment and qualifying for financing will not be a problem, but you want the best mortgage for your needs, and of course, the lowest interest rate available. Sound like you? Read on . . .

Or maybe you just have no idea what you qualify for, this is your first purchase and you just want to learn how to get started (on the right foot). Well, read on . . .

Below is a brief outline of some basic components of getting financing and some tips to get you well ahead of the game.

Traditional Banks

An advantage of using banks rather than mortgage brokers is that you get to deal with someone who knows a lot more than just mortgages. Often, what is best for you in terms of a mortgage might also play into your long term financial planning, and a mortgage broker may not be able to help you align the two. For example, your bank can take into account any credit cards or lines of credit that you may have, along with any savings or RRSP accounts to make sure you have high cash flow and low borrowing costs.

Although getting you approved for your mortgage may be your number one priority, a bank will work with you to make sure that whatever you end up with suits your lifestyle and matches your long term goals.

Some banks even have access to alternative lending sources that may be able to help if your credit is less than perfect or a transaction is out of the ordinary. Ask your banker to find out which options they provide.

Although getting you approved for your mortgage may be your number one priority, a bank will work with you to make sure that whatever you end up with suits your lifestyle and matches your long term goals.

Some banks even have access to alternative lending sources that may be able to help if your credit is less than perfect or a transaction is out of the ordinary. Ask your banker to find out which options they provide.

Mortgage Brokers

Brokers are typically self employed and are paid by the lenders (or banks) and not by you. This means that they are motivated to get you approved and also give you great service in the hopes of future referrals. They use as many as 30 different lending sources, which even include a lot of major banks.

One of the greatest advantages of using a mortgage broker is that they work with hundreds of unique situations, often have friends in the right places and know some tricks to ensure your mortgage gets the green light. If a traditional bank denies you, a mortgage broker might be able to help.

One of the greatest advantages of using a mortgage broker is that they work with hundreds of unique situations, often have friends in the right places and know some tricks to ensure your mortgage gets the green light. If a traditional bank denies you, a mortgage broker might be able to help.

Lines of Credit

TAKE NOTE: By financing your home with a line of credit, rather than a mortgage, there are some serious benefits. The line of credit will be secured against the home similar to a mortgage; however the payment options are sometimes wide open. There are no penalties for paying off a large lump sum or clearing it completely (very important when you sell). If your monthly finances are a little short, or if monthly cash flow is the goal, then on some LOCs you can make interest only payments which will maximize your monthly income. A line of credit can also be a better way to refinance your home. You can use as much, or as little, of it as you need, and only make payments on the portion you have used.

Creative Financing

How do people buy homes with no money or no credit? Well, some banks still offer zero down mortgages, however you still have to have good credit and income. Some self-employed people have lots of money, but can’t prove their income. Sometimes you need non-traditional methods of financing. Here are a few possibilities:

Private Lenders – some lenders will work with high risk clients and simply charge a higher interest rate

Joint Ventures - get someone else to front the money for the home and you split the future returns

Vendor Take Backs – Have the owner carry the mortgage

Assumable Mortgages – Agree to take-over the existing mortgage (only available in certain places)

Other Options – Combinations of the above and others unique to the particular laws governing the area

Private Lenders – some lenders will work with high risk clients and simply charge a higher interest rate

Joint Ventures - get someone else to front the money for the home and you split the future returns

Vendor Take Backs – Have the owner carry the mortgage

Assumable Mortgages – Agree to take-over the existing mortgage (only available in certain places)

Other Options – Combinations of the above and others unique to the particular laws governing the area

Summary

If you have enough motivation and the proper guidance, there is nothing holding you back from finding the money to purchase real estate. The key thing is to check out all your options. If you plan on spending $100,000’s on a new home, it will be well worth your time to do a little homework.

Don’t let everyone pull your credit rating, have the bank run some hypothetical examples and once you find one or two you trust, then pull the details. The more times your credit is pulled, the lower your credit rating becomes. Get pre-approved and lock into an interest rate. Some lenders will hold a rate for up to 120 days. If the rate is lower when you take possession, you get the lower rate anyway. Don’t get caught if rates climb. Be careful whose advice you take. Some REALTORS® are paid incentives based on the business they send a mortgage broker. Ask your REALTOR® why they recommend someone and if they receive an incentive. Review the terms of your mortgage in depth and be sure you understand the pay-out options, conditions, interest rates, etc. It can be a nasty surprise if your payment suddenly jumps or you have a large penalty for getting out early.

If you are not approved, ask why not and find out what options you have to get approved (if they can’t tell you then find someone else). Sometimes it would just take an additional letter from an employer or something simple to remedy. There is always a way.

Source: Lindsey Smith of the Entyro Service Group in Calgary ABDon’t let everyone pull your credit rating, have the bank run some hypothetical examples and once you find one or two you trust, then pull the details. The more times your credit is pulled, the lower your credit rating becomes. Get pre-approved and lock into an interest rate. Some lenders will hold a rate for up to 120 days. If the rate is lower when you take possession, you get the lower rate anyway. Don’t get caught if rates climb. Be careful whose advice you take. Some REALTORS® are paid incentives based on the business they send a mortgage broker. Ask your REALTOR® why they recommend someone and if they receive an incentive. Review the terms of your mortgage in depth and be sure you understand the pay-out options, conditions, interest rates, etc. It can be a nasty surprise if your payment suddenly jumps or you have a large penalty for getting out early.

If you are not approved, ask why not and find out what options you have to get approved (if they can’t tell you then find someone else). Sometimes it would just take an additional letter from an employer or something simple to remedy. There is always a way.

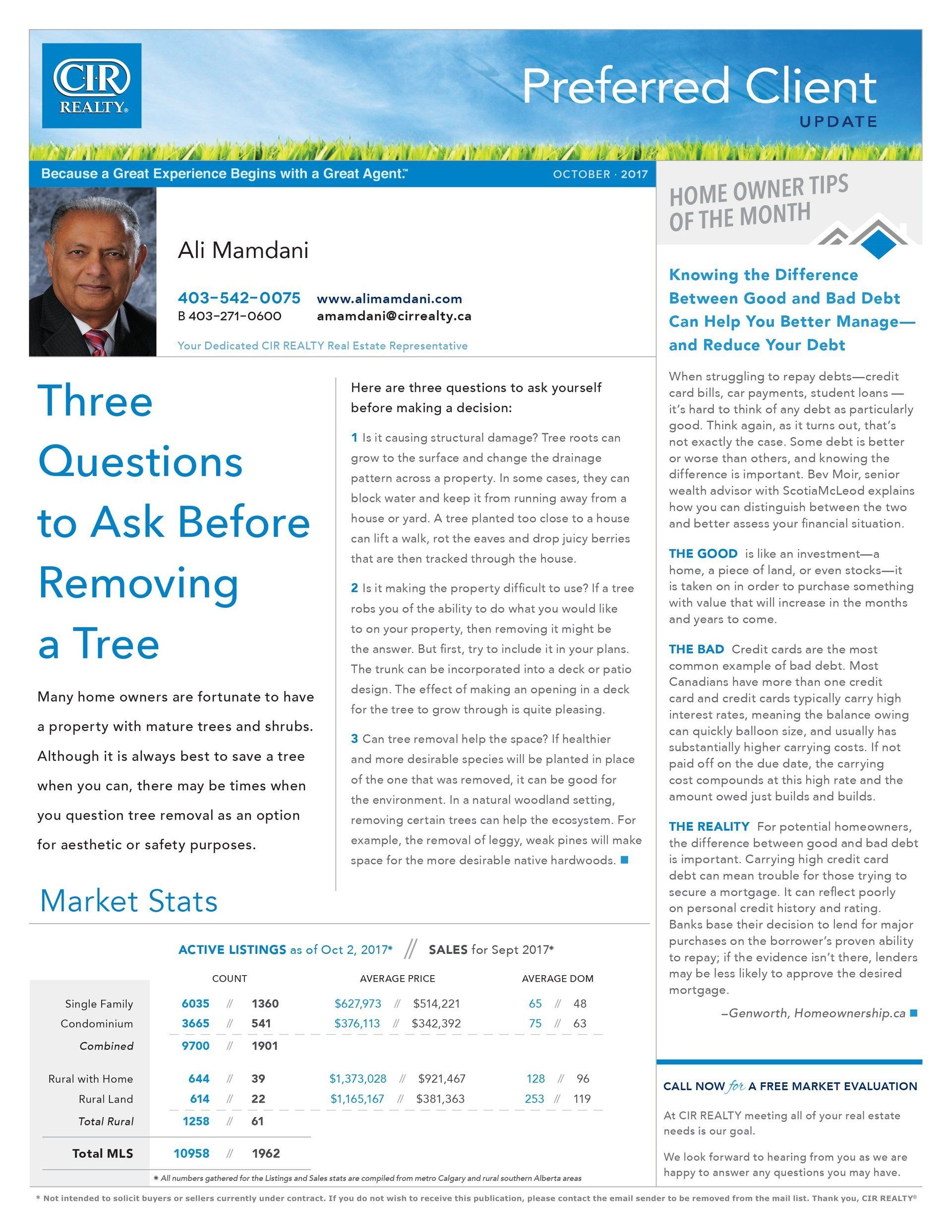

Many home owners are fortunate to have a property with mature trees and shrubs. Although it is always best to save a tree when you can, there may be times when you question tree removal as an option for aesthetic or safety purposes.

Here are three questions to ask yourself before making a decision:

1. Is it causing structural damage?

Tree roots can grow to the surface and change the drainage pattern across a property. In some cases, they can block water and keep it from running away from a house or yard. A tree planted too close to a house can lift a walk, rot the eaves and drop juicy berries

that are then tracked through the house.

2. Is it making the property difficult to use?

If a tree robs you of the ability to do what you would like to on your property, then removing it might be the answer. But first, try to include it in your plans. The trunk can be incorporated into a deck or patio design. The effect of making an opening in a deck

for the tree to grow through is quite pleasing.

3. Can tree removal help the space?

If healthier and more desirable species will be planted in place of the one that was removed, it can be good for

the environment. In a natural woodland setting, removing certain trees can help the ecosystem. For

example, the removal of leggy, weak pines will make space for the more desirable native hardwoods.

Here are three questions to ask yourself before making a decision:

1. Is it causing structural damage?

Tree roots can grow to the surface and change the drainage pattern across a property. In some cases, they can block water and keep it from running away from a house or yard. A tree planted too close to a house can lift a walk, rot the eaves and drop juicy berries

that are then tracked through the house.

2. Is it making the property difficult to use?

If a tree robs you of the ability to do what you would like to on your property, then removing it might be the answer. But first, try to include it in your plans. The trunk can be incorporated into a deck or patio design. The effect of making an opening in a deck

for the tree to grow through is quite pleasing.

3. Can tree removal help the space?

If healthier and more desirable species will be planted in place of the one that was removed, it can be good for

the environment. In a natural woodland setting, removing certain trees can help the ecosystem. For

example, the removal of leggy, weak pines will make space for the more desirable native hardwoods.

“Should I sell in this Buyer’s Market or wait until we’re in a Seller’s Market

again?”

Increases to income tax rates

brought in by the new provincial

government have come fully into

effect in after being partially

implemented in October of 2015.

Many people want to know what the secret is to getting the most out of their real estate and to appeal to most consumers looking for real estate today. This report will guide you through doing many of those things to help get the most dollars when selling your property.